Due to the ongoing rise of healthcare costs, many employers with self-insured health plans often purchase stop loss coverage in order to protect themselves against catastrophic or unpredictable losses associated with high-cost claimants. This coverage is not medical insurance; but rather, it’s a financial and risk management tool that protects the employer from excessive claims.

Stop loss is used in two ways:

- “Specific stop loss” is used by health plans to cap the limit on claim liability for any covered member. The stop loss insurance coverage reimburses the employer if any participant’s claims exceed a specified per-individual deductible amount.

- Under “aggregate stop loss,” employers are protected from costs that exceed a threshold for the entire group of plan participants. All participant claims under the specific deductible are combined in one “pool.” When the total of these claims reaches a set dollar amount, the stop loss carrier begins to pay claims

One Stop for Stop Loss

Timely reporting to employers on incurred medical expenses and utilization, as it relates to their stop loss coverage, is critical. At MedeAnalytics, we offer advanced Stop Loss Reporting as an optional module within the Employer Reporting product. Health plans can quickly identify high cost claimants and members with trigger diagnoses, which are those diagnoses likely to lead to high cost claimant status. Health plans also gain the insights they need to implement preventive health programs or devise other strategies to help mitigate expenses.

This module helps employers:

- Manage high-cost claimants and provide a complete picture of their cost and use of healthcare services in a secure, cloud-based solution integrated with health plan benefits

- Eliminate manual processing to save time and resources

- Automate reporting for carved out stop loss policies purchased from a third party and products purchased from the employer’s health plan

- Ensure data security standards by using robust role-based security to display only relevant data to each employer.

The MedeAnalytics solution is integrated with health plan benefits and provides employers with a complete picture of their cost and utilization of healthcare services.

Interested in learning about our other Employer Reporting solutions? Visit our Payer Solutions page.

Get our take on industry trends

Best practice tools to build an integrated approach to multimorbidity

The traditional model of treating single diseases no longer works. Data collected from 2016 to 2019 indicated that 32.9% of…

Read on...Will adopting a risk-based approach with augmented analytics support care gap closure?

A common challenge for healthcare systems is how to properly segment its patient populations based on risk profiles and co-morbidities. Doing this well ensures a high quality of care delivery and superior patient outcomes.

Read on...4 questions healthcare executives are asking about augmented analytics

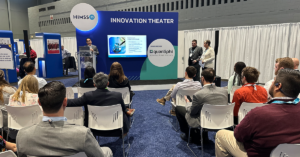

At our annual Impact Summit, I had the privilege to talk about augmented analytics and address questions from healthcare executives—many…

Read on...